The Good Brigade/DigitalVision via Getty Images

REITs had a decent run in the 12 months leading up to May, and that’s when everything started to fall apart. Concerns of mounting inflation, rising rates, and tenant profitability have put a damper in the share prices of many REITs, and the shopping center segment has not been immune to this.

This brings me to Brixmor Property Group (NYSE:BRX), which has seen material share price weakness in recent weeks. In this article, I highlight what makes BRX a quality income buy amidst the market chaos, so let’s get started.

Why BRX?

Brixmor Property is one of the largest shopping center REITs in the US, owning and operating a high quality portfolio of 380 retail centers covering 67 million square feet. Its properties are well-located and spread throughout 118 metropolitan statistical areas, and are diversified across over 5K national, regional, and local tenants.

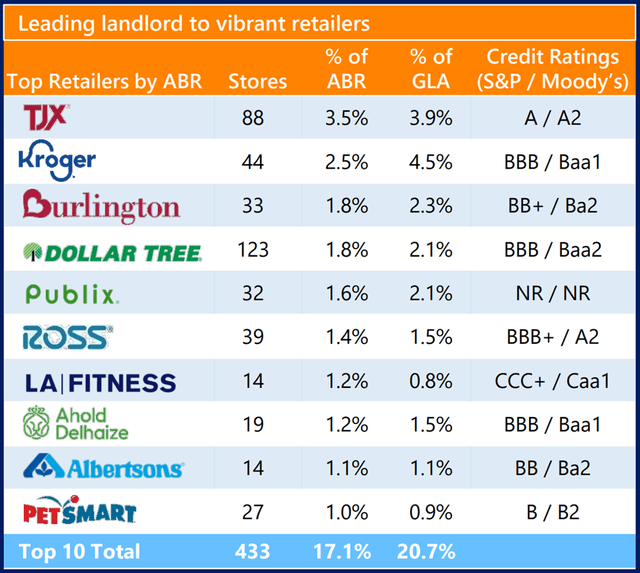

As shown below, the majority of BRX’s top 10 tenants are either top grocers like Kroger (KR) and Publix, or well-known and popular discount chains such as TJ Maxx (TJX), Ross Stores (ROST), and Dollar Tree (DLTR) ).

Brixmor’s Top Tenants (Investors Presentation)

BRX’s stock price has taken a beating of sorts lately, falling from the $27-level achieved just recently in late April to $21.79. It currently carries an RSI score of 35, indicating that the stock is approaching oversold territory.

Concerns around BRX may revolve around the possibility for a recession, which may hurt tenant profitability, and around higher interest rates. I see BRX as being well-positioned in face of these risks, however, as over 70% of its centers are either grocery-anchored or led by discount retailers, thereby making them more recession- and ecommerce resistant.

Moreover, BRX’s maintains a solid occupancy of 92%, and this includes 87% small-shop occupancy, sitting above the 85% level that I view as being healthy. Also encouraging, BRX is seeing strong tenant demand for its properties, executing on 780K square feet of new leases during the first quarter, the highest Q1 total since 2018.

It’s also seeing strong rental growth rates, with a blended new and renewal lease spread of 18%. Notably, its new lease spread of 31% is significantly higher than the 12% peer averages. These factors helped to drive a respectable 8.4% YoY same-store NOI growth and an impressive 11.4% YoY FFO/share growth.

BRX also appears to be well-positioned in the face of rising rates, as it recently received a credit ratings bump to BBB flat (up from BBB-) from Fitch. It also maintains plenty of liquidity at $1.4 billion and has no debt maturities until 2024. This lends support to BRX’s 4.4% dividend yield, which is well-protected by a low 49% payout ratio (based on Q1 FFO per share of $0.49). The dividend was last raised by 11.6% in November of last year, and I would expect to see another healthy raise this year.

Looking forward, I remain optimistic over BRX’s prospects, as management has proved adept at recycling capital, and has an active acquisition pipeline, as noted during the recent conference call:

To date, we’ve delivered over $720 million of accretive reinvestments impacting over 30% of our portfolio and our pipeline remains strong with an additional $419 million of active reinvestment projects leased and underway at an average incremental return of 9%, as well as the shadow pipeline of nearly $1 billion of opportunities at compelling returns that we’ll continue to convert to active over the next several years.

We invite you to tour our assets with our regional teams in markets like Southern California, Texas, Chicago, South Florida, Philadelphia, and New York to not only see the transformation that has occurred, but the value to come as we continue to execute upon our disciplined strategy of capitalizing on attractive rent basis.

I see value in BRX after the recent price drop. At the current price of $21.79, BRX carries a forward P/FFO of just 11.3, sitting well below that of close peer Kimco Realty (KIM), which comes with a forward P/FFO of 13.5. Sell side analysts have a consensus Buy rating on BRX with an average price target of $27.83, implying a potential one-year total return of 32% including dividends.

Takeaway Investors

I see value in Brixmor’s stock after its recent sell-off, and believe that it is well-positioned in face of potential risks such as a recession or higher interest rates. Moreover, management has proven adequate at recycling capital, and it has plenty of liquidity to fund its active acquisition pipeline. Long-term dividend investors may do well to buy the drop on this quality stock.